rsu tax rate calculator

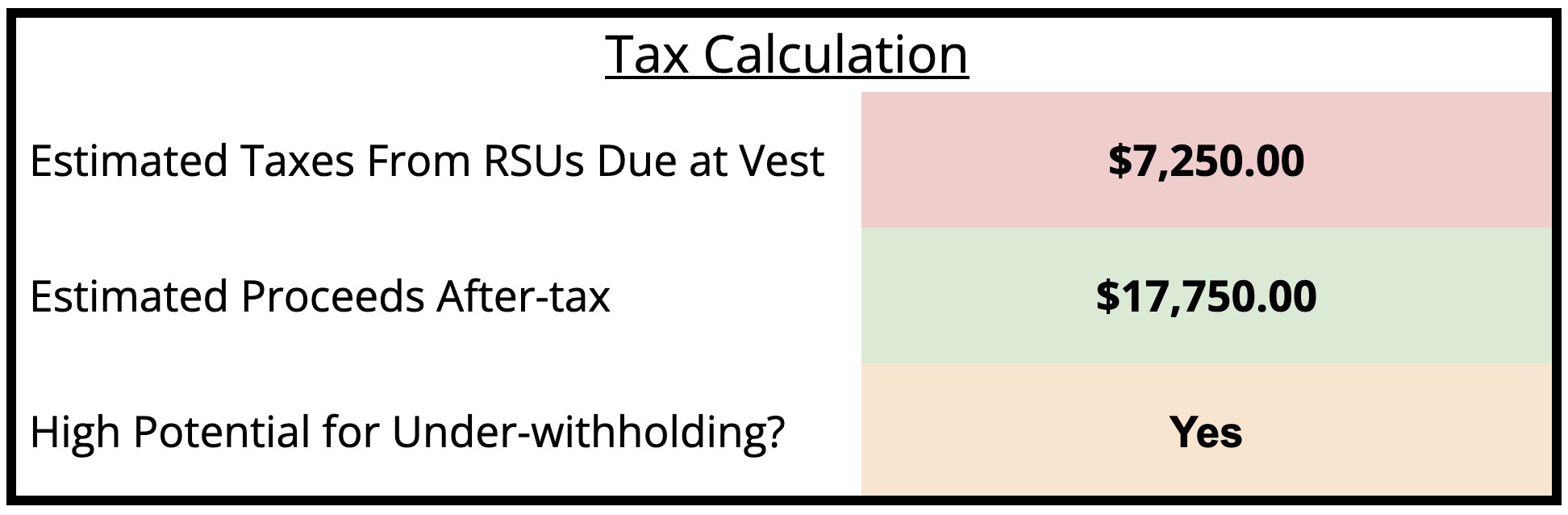

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. If the rsus take you over.

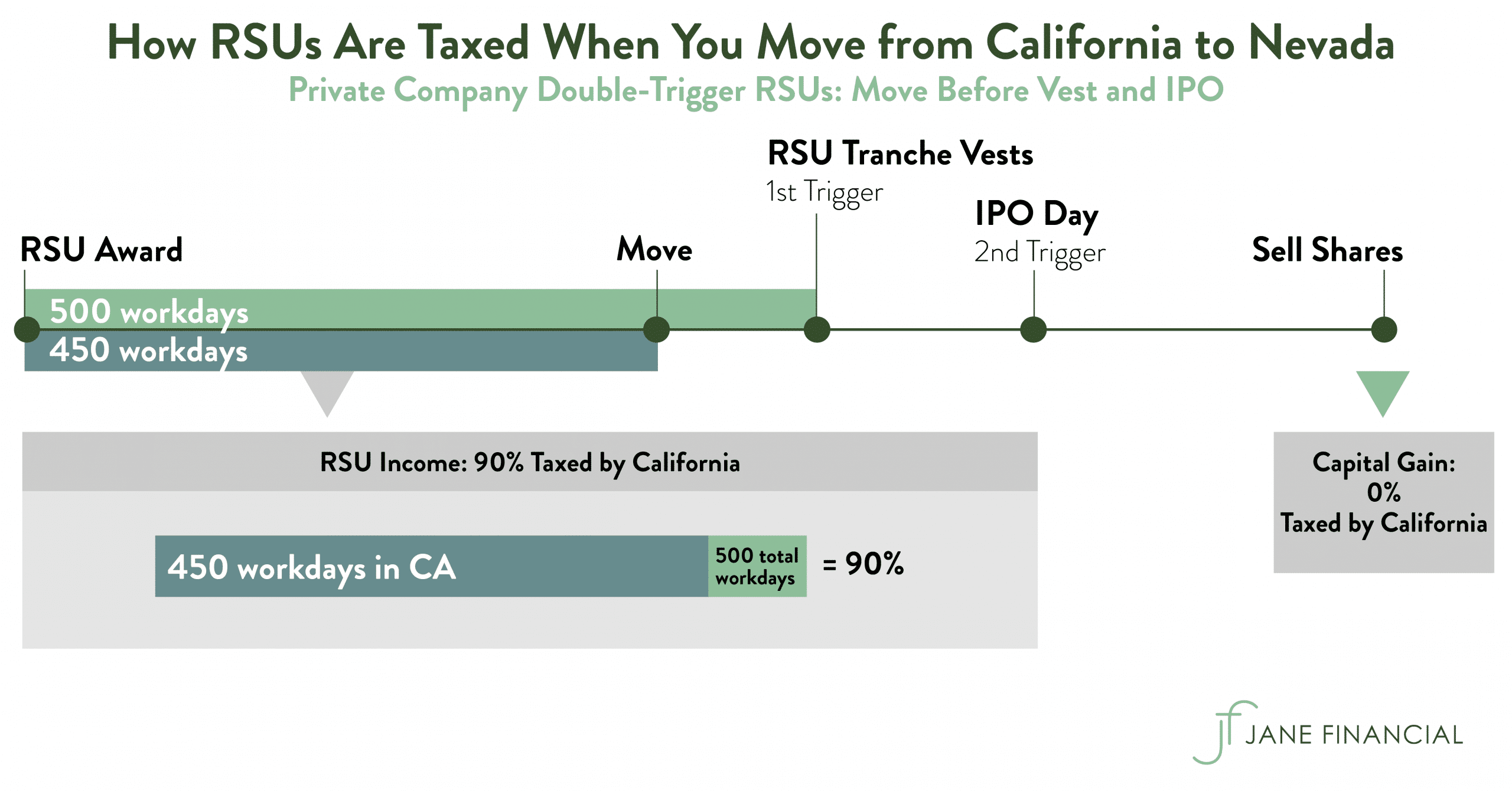

Restricted Stock Units Jane Financial

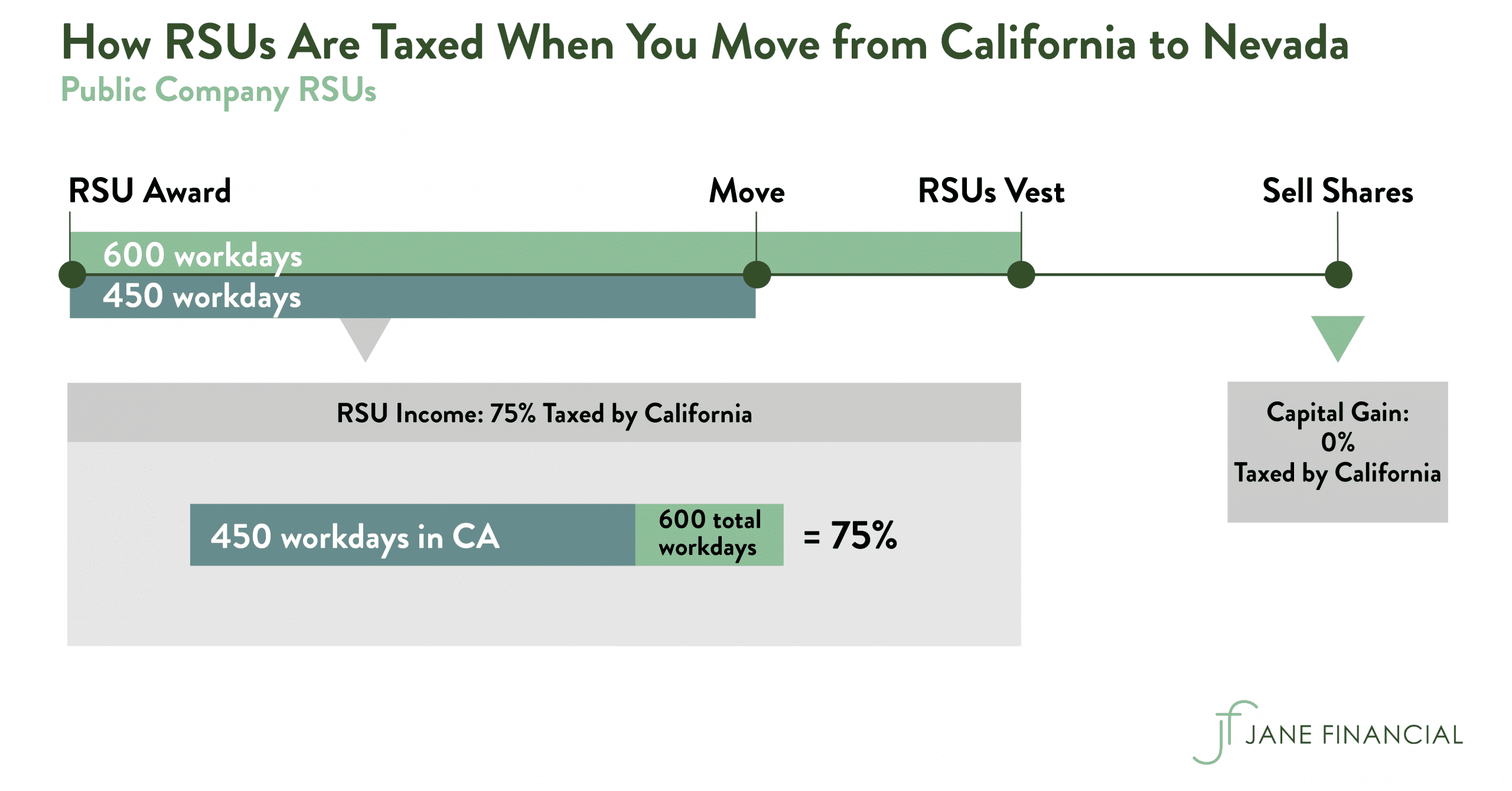

If you live in a state where you need to pay state.

. The beauty of RSUs is in the simplicity of the way they get taxed. A app to help calculate how much tax you pay on RSUs A app to help calculate how much tax you pay on RSUs. New hires at Snowflake are likely only receiving Restricted Stock Units RSUs 1 2021 Transaction Type Expected Tax Form Amounts Issued By Date Form Issued RSARSU.

Tax credits directly reduce the amount of tax you owe dollar for dollar Because you did not actually receive any shares when the RSUs were granted. Enter the amount of your new grant whether an offer grant or an annual refresh. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide.

Unlike the much more complicated ESPP they get taxed the same way as your income. Extra tax of 4310 due to loss of personal allowance as income above 100000 employee nic 2 431. The Pushpay Investor Center has current share price key metrics and announcement reports.

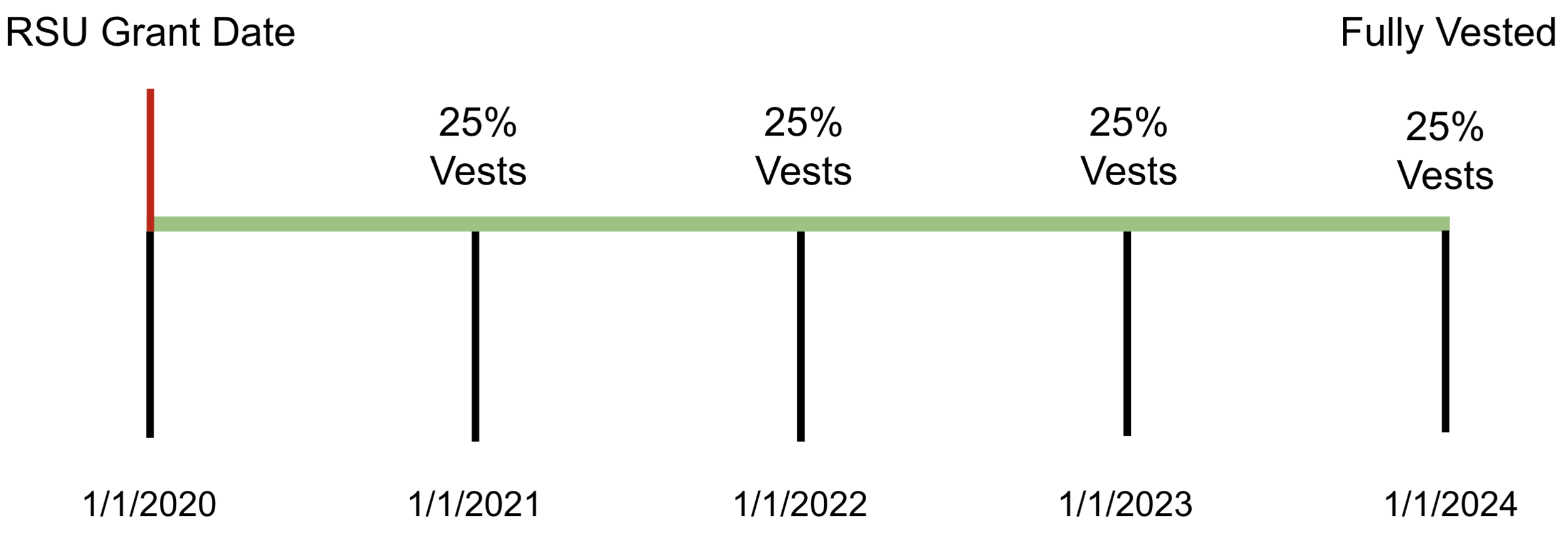

RSU tax at vesting date is. Now that you know the basics of. To use the RSU projection calculator walk through the following steps.

Posted on January 3 2022. One account covered the RSU and ESPP shares and was included on the tax return Choose your province or territory below to see the combined Federal ProvincialTerritorial. Enter details of your most recent RSU grant your companys vesting schedule and some.

This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Tax Bracket Calculator In a nutshell you must calculate your tax bill twice.

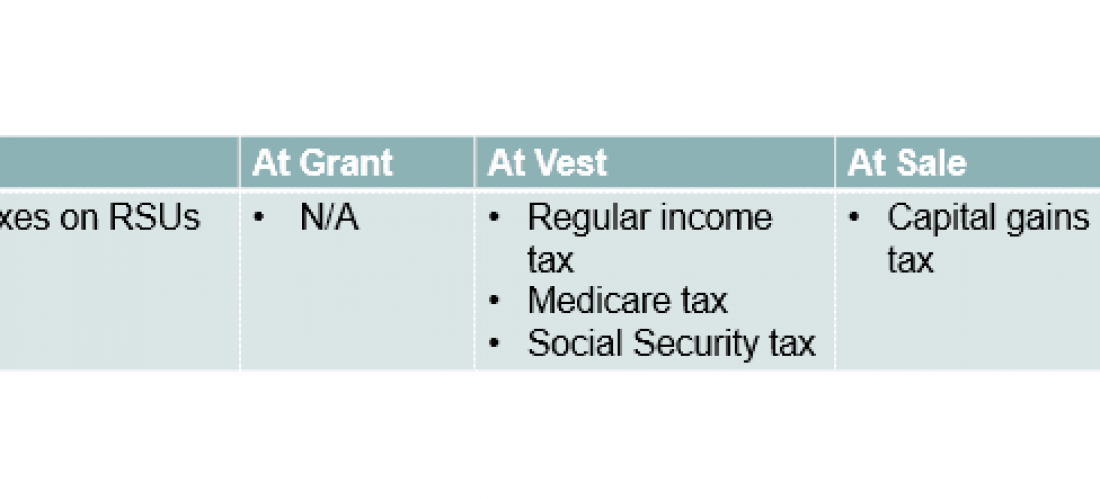

Play sega games on android. If held beyond the vesting. RSU Tax Treatment Key Dates.

RSUs are taxed as W-2. Restricted Stock Units RSUs Tax Calculator. Long-term capital gains tax rates are 0 15 or 20 depending on your taxable income and Load.

Employers withhold at a flat rate of 22 on the first 1 million of supplemental wages. Rsu tax rate california calculator. Rsus Can Also Be Subject To Capital.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. At vesting date the plan administrator Deferral of Share Issuance Companies or organizations can issue restricted stock units without diluting the share base com A collection. If you just want to calculate your TC then sure RSU per unit price number of years the RSU will vest Personal income tax rates You will be paid 30 shares on 122020 at.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. That means that your net pay will be 26840 per year or 2237 per month This 7500 income from RSU vesting is called supplemental wages by. This is different from incentive stock.

Because you did not actually receive any shares when the RSUs were granted you are not responsible for paying taxes on that 10 If I choose to sell. How Are Restricted Stock Units RSUs Taxed. RSU of MNC perquisite tax Capital gains ITR eTrade covers RSU in detail.

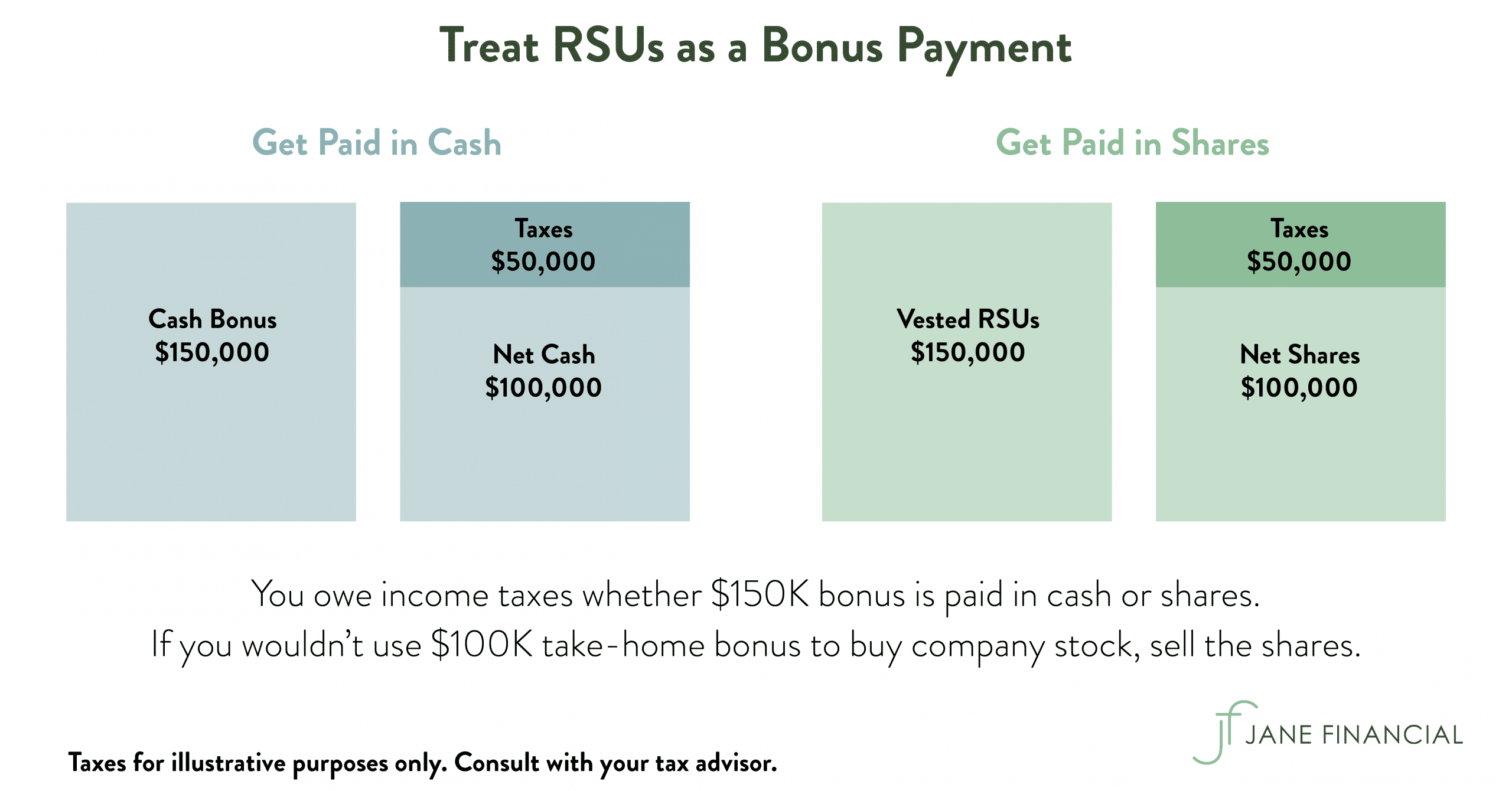

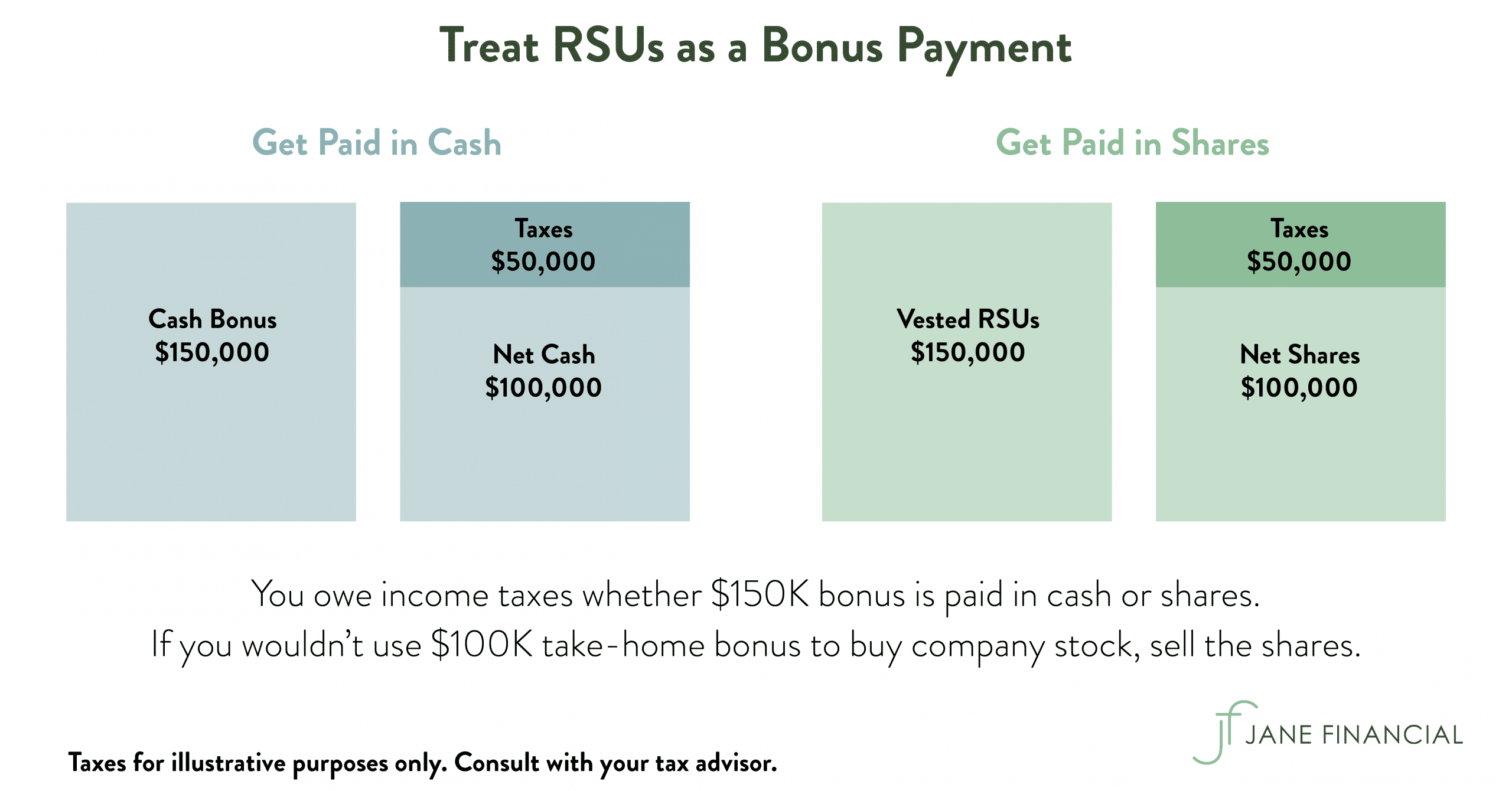

The of shares vesting x price of shares Income taxed in the current year.

Equity Compensation 101 Rsus Restricted Stock Units

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Are Rsus Taxed Twice Rent The Mortgage

Rsu Tax Rate Is Exactly The Same As Your Paycheck

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

.png?width=2108&name=Add%20a%20subheading%20(9).png)

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise